delayed draw term loan accounting

ARTICLE II AMOUNTS AND TERMS OF THE LOANS 20. DELAYED DRAW TERM LOAN AGREEMENT.

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and.

. And WACHOVIA BANK NATIONAL ASSOCIATION as Co. DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years.

DDTLs are usually used by businesses that would like to purchase capital refinance debt or make acquisitions. Good understanding of loan based products ideally term loans revolvers delayed draw private originated debt Solid understanding of fund accounting across complex asset classes Excellent written and verbal communication skills suitable for client meetings. The Company funded the purchase price for this acquisition and related costs and expenses through term and revolving loan borrowings under its senior secured credit facility including a 900.

GTT Secures Commitment for New Term Loan Facility to Strengthen Liquidity Position. A decade ago these were generally one year. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times.

The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan. Key Takeaways A delayed draw term loan DDTL allows you to withdraw funds from one loan amount several times through predetermined. This CLE course will discuss the terms and structuring of delayed draw term loans.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time period ie the reporting entity gets to choose the date that the debt funds within a. A transaction involving the issuance of a new term loan or debt security to one lender or investor and the concurrent satisfaction of an existing term loan or debt security to another unrelated lender or investor is always accounted for as an extinguishment of the existing debt and issuance of new debt.

Rules of Construction. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt and thus the additional. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay.

This contrasts with commitment fees on revolvers of 50bp. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. While you may enjoy the flexibility and save money on.

The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first borrowing of Delayed Draw Term Loans on the last day of each March June September and December each in an amount equal to one and one-quarter percent 125 of the aggregate. Committed to providing the company with a new 275 million delayed-draw term loan. When the delayed draw term loan is used to fully repay the converts the Company will not have any substantial maturities prior to February 2027 other than its asset-based revolving credit facility.

A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. That sentiment is driving longer draw periods in delayed-draw loans. Delayed Draw Term Loan Availability Period means the period from and including the Closing Date and ending on the earliest of the following.

Proceeds from the planned issuance along with a 350 million revolver draw and previously committed 11 billion delayed draw term loan will be used to fund a 22 billion distribution to. The lenders approve the term loans once with a maximum credit limit and charge variable interests on them. May consist of immediately funded or delayed-draw term loans or of revolving credit commitments May be implemented as either a new credit facility or as an upsizing of an existing credit facility May be implemented via an amendment agreement an incremental assumption agreement or an amendment and restatement of the existing credit.

ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. In a review of certain. The revolving loans are approved for the short-term usually up to one year.

An accordion feature is an option that a company can buy that gives it the right to increase its line of credit or similar type of liability with a. The delayed draw term loan has a nominal ticking fee and the Company is not required to draw any amounts prior to June 30 2022. Delayed Draw Term Loans.

THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE COMPANY OF NEW MEXICO a New Mexico corporation as Borrower the Lenders MORGAN STANLEY SENIOR FUNDING INC. Like revolvers delayed-draw loans carry fees on the unused portion of the facilities. I the first day on which the aggregate amount of the Delayed Draw Term Loans advanced hereunder is equal to 25000000 ii the date that is the eighteen 18 month anniversary of the Closing Date and iii such earlier date on which the.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Conducted on Wednesday April 29 2020.

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Finance Saving

Delayed Draw Term Loans Financial Edge

Balance Sheet Long Term Liabilities Accountingcoach

Delayed Draw Term Loan Ddtl Overview Structure Benefits

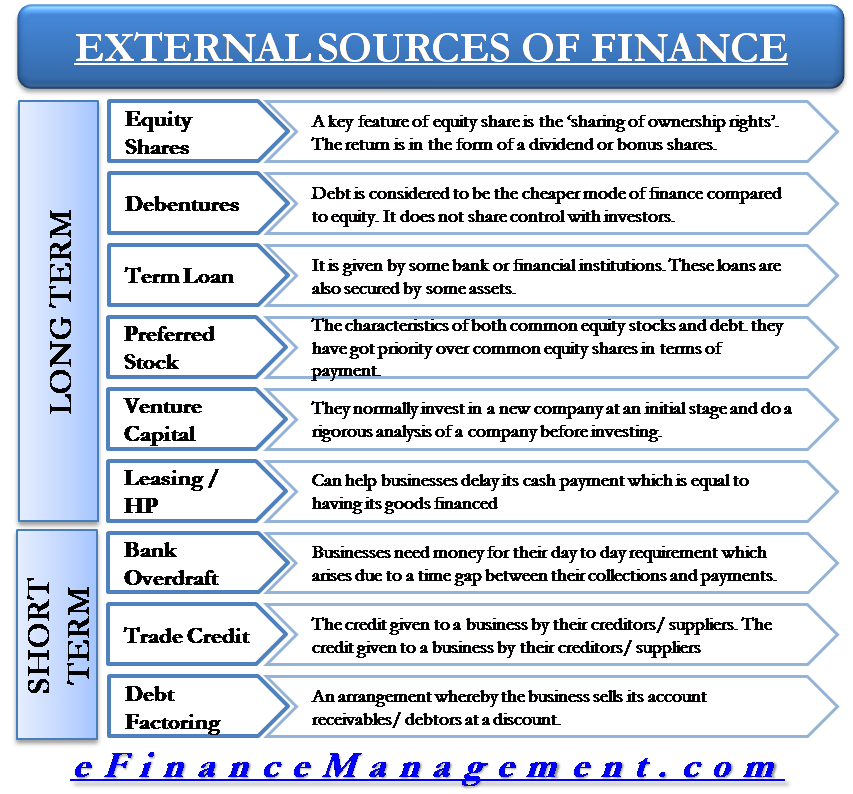

External Sources Of Finance Capital

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Financing Fees Deferred Capitalized Amortized

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

Financing Fees Deferred Capitalized Amortized

Financing Fees Deferred Capitalized Amortized

Ryan Irvin Director Old Capital Linkedin

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Understanding The Construction Draw Schedule Propertymetrics

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics